What you need to know

Investing can build enough wealth to provide financial security and a comfortable lifestyle but it can be complex and there are many options to choose from, so it is important that you have the right professional advice.

How to choose investments

It’s easy to choose a savings account, but far more complex to decide on your long-term investment strategy.

You will need to be clear on the differences between the four major asset classes – cash, bonds, property and shares – and between fund managers. You will also need to understand the various risks and returns involved in investing and work out what level of risk you are comfortable with.

Risk and return

All investments aim to provide a certain level of return and are subject to certain risks. One way to manage investment risk is to ensure you hold the investment for an appropriate length of time, generally five to seven years for share investments, to ride out any short-term fluctuations in value.

As a general rule, the bigger the potential investment return, the higher the investment risk, and the longer the suggested investment time frame.

At FinNest Financial, we help you make the right choices to support your investment goals and give you comfort to know that our thorough process and knowledge provides the best fit between your needs and what you invest in.

Setting goals

When making plans for the future you need to know what you want to achieve and by when. To get to this point, it’s a good idea to seek professional help. A qualified financial adviser can explain the various options available and provide advice on the most appropriate direction for you.

At FinNest Financial we can help you set goals, establish your priorities and develop an investment strategy suited to your circumstances. We’ll help you build wealth, achieve your objectives and create a more secure financial future.

The sooner the better

The sooner you put your money to work, the more time it has to grow and ultimately give you the best opportunity to achieve your investment goals.

At FinNest Financial, our ongoing support ensures that your money is invested wisely and continues to be the right investment for what you would like to achieve. It’s a process that takes discipline and vigilance from the FinNest team and it’s a key part of the support we provide our happy clients. Click here to see some examples of the wonderful outcomes we have provided to our clients.

To find out how we can help you plan a successful retirement, call 07 3831 7629 or email us today.

Case Studies

How the right advice can help

You can use a number of strategies to achieve your Investing goals. The following case studies provide examples of this.

Dean and Jenny are in their 30s and have a four-month-old baby, Alice. To ensure they’ll be able to afford Alice’s education, Dean and Jenny decide to start a dedicated savings plan. They estimate that by the time Alice is 11 they will need to have saved $84,000 (in today’s dollars) to meet her annual private high school fees of around $14,000 for six years.

Dean and Jenny choose a managed fund with a regular savings plan option. They kick off their savings with a lump sum of $5,000 and decide to invest a further $460 every month. Based on projected earnings of 7.7% pa and taking inflation of 3.0% pa into consideration, this means they should accumulate around $86,000 in 11 years.

If Dean and Jenny keep the savings plan going for the entire 11 years, they will be well placed to fund Alice’s private high school education when the time comes.

By maintaining the discipline of making monthly investments without touching these savings, Dean and Jenny will reap a great reward from compounding interest. This occurs when you leave the interest you earn in the account, so that you begin earning interest on your interest. The effect may be small at first, but if you leave the interest to accumulate in the account it can gradually snowball over time and significantly boost your savings.

Notes

1. The estimated balance required and estimated school fees are in today’s dollars. 2. The projected earnings of 7.7% are after fees and before taxes have been taken into account. No allowance has been made for taxation, including capital gains tax on investment earnings. Please remember fees and taxes have an impact on long-term returns.

Disclaimer

This case study and any graphs or examples included in this case study are for illustrative purposes only and are based on specific assumptions and calculations. Individual circumstances may vary and this will alter the outcome. The case study does not represent any forecast or guarantee on return.

The information provided on this website is intended to provide general information only and the information has been prepared without taking into account any particular person’s objectives, financial situation or needs. Before acting on such information, you should consider the appropriateness of the information having regard to your personal objectives, financial situation or needs. In particular, you should obtain professional advice before acting on the information contained on this website and review the relevant Product Disclosure Statement (PDS).

Relevant PDSs can be obtained by contacting us. No representation or warranty is made as to the accuracy, completeness or reliability of any estimates, opinions, conclusions or other information contained on this website. This website may contain certain forward-looking statements. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control. You should not place reliance on forward-looking statements. To the maximum extent permitted by law, we and Matrix Planning Solutions Limited disclaims all liability and responsibility for any direct or indirect loss or damage which may be suffered as a result of relying on anything on this website including any forward looking statements. Past performance is not an indication of future performance.

Finnest Financial Pty Ltd ACN 163 390 547 is a Corporate Authorised Representative No. 440812 of Matrix Planning Solutions Limited ABN 45 087 470 200. AFS & ACL 238256.

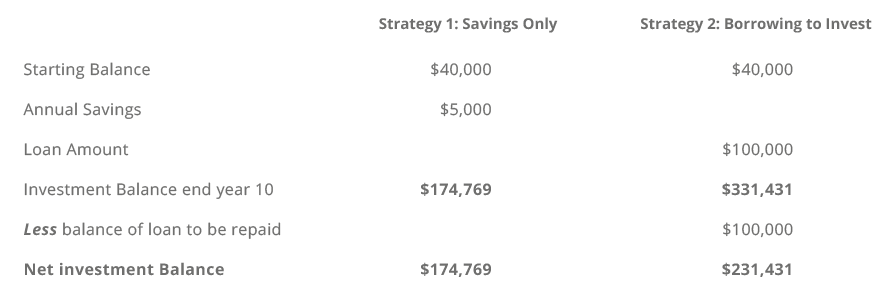

Sarah wants to examine ways to prudently grow her asset base over the long term. With the right advice and discipline, Sarah has paid off a good amount of her home loan. Sarah has some surplus savings capacity and using that has tucked away $40,000 of additional savings. Sarah has heard of strategies where she could borrow against her home to allow her more capital to invest. If Sarah borrowed $100,000 against her house to invest, and her interest rate was 5%, it would cost her $5,000 per year before she claimed a tax deduction on the interest cost. So would Sarah be better off continuing to save $5,000 per year to add to her starting balance of $40,000, or borrowing $100,000 and adding this to her starting investment sum of $40,000?

However, Sarah understands that borrowing to invest (a strategy known as gearing) also means she has the potential to lose a lot more – and if her chosen investments don’t perform well, she will have to repay the loan regardless.

Sarah chooses to invest her money in a managed fund. As you can see in the table below, based on an annual return of 9%, at the end of ten years if Sarah had just relied on $5,000 per year of savings alone, her investment would be worth around $174,700. However, if Sarah had borrowed $100,000 and spent her $5,000 per year on interest repayments instead of savings, her investment (even after repaying the $100,000 loan) is worth over $56,600 more than savings alone!

Sarah’s strategy is easy and tax-effective. Even after allowing for the interest payments and the final repayment of the loan, she is well ahead of where she could be by saving alone. Because she is borrowing for investment purposes, she may also be able to claim the interest paid on her loan as a tax deduction, further increasing the value of her strategy.

It is important to remember that borrowing to invest does involve significant risks. Although it has the potential to magnify gains, it will also magnify any losses suffered if the value of your investment falls. FinNest Financial can help you decide whether a geared investment strategy is appropriate for you.

Notes

Notes

Assumes the same growth investment for each strategy with an average return of 9% pa (4% income plus 5% growth, with a 50% franked component of income return). Return assumes dividends are reinvested, a marginal tax rate of 39% (including Medicare), and an average loan interest rate of 5% pa. Excludes brokerage and any other fees. Inflation has not been considered. Over long periods, inflation can reduce the purchasing power of your money.

** This example is for illustrative purposes only. It does not represent the past or expected performance of any particular fund, portfolio or investment. Any changes to taxation, loan interest rates, investment returns, or the other assumptions will affect the outcome.

Disclaimer

This case study and any graphs or examples included in this case study are for illustrative purposes only and are based on specific assumptions and calculations. Individual circumstances may vary and this will alter the outcome. The case study does not represent any forecast or guarantee on return.

The information provided on this website is intended to provide general information only and the information has been prepared without taking into account any particular person’s objectives, financial situation or needs. Before acting on such information, you should consider the appropriateness of the information having regard to your personal objectives, financial situation or needs. In particular, you should obtain professional advice before acting on the information contained on this website and review the relevant Product Disclosure Statement (PDS).

Relevant PDSs can be obtained by contacting us. No representation or warranty is made as to the accuracy, completeness or reliability of any estimates, opinions, conclusions or other information contained on this website. This website may contain certain forward-looking statements. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control. You should not place reliance on forward-looking statements. To the maximum extent permitted by law, we and Matrix Planning Solutions Limited disclaims all liability and responsibility for any direct or indirect loss or damage which may be suffered as a result of relying on anything on this website including any forward looking statements. Past performance is not an indication of future performance.

Finnest Financial Pty Ltd ACN 163 390 547 is a Corporate Authorised Representative No. 440812 of Matrix Planning Solutions Limited ABN 45 087 470 200. AFS & ACL 238256.